Some Known Incorrect Statements About Unicorn Finance Services

Table of ContentsThe Ultimate Guide To Unicorn Finance ServicesUnicorn Finance Services Can Be Fun For AnyoneUnknown Facts About Unicorn Finance ServicesGetting The Unicorn Finance Services To WorkFacts About Unicorn Finance Services UncoveredAbout Unicorn Finance Services

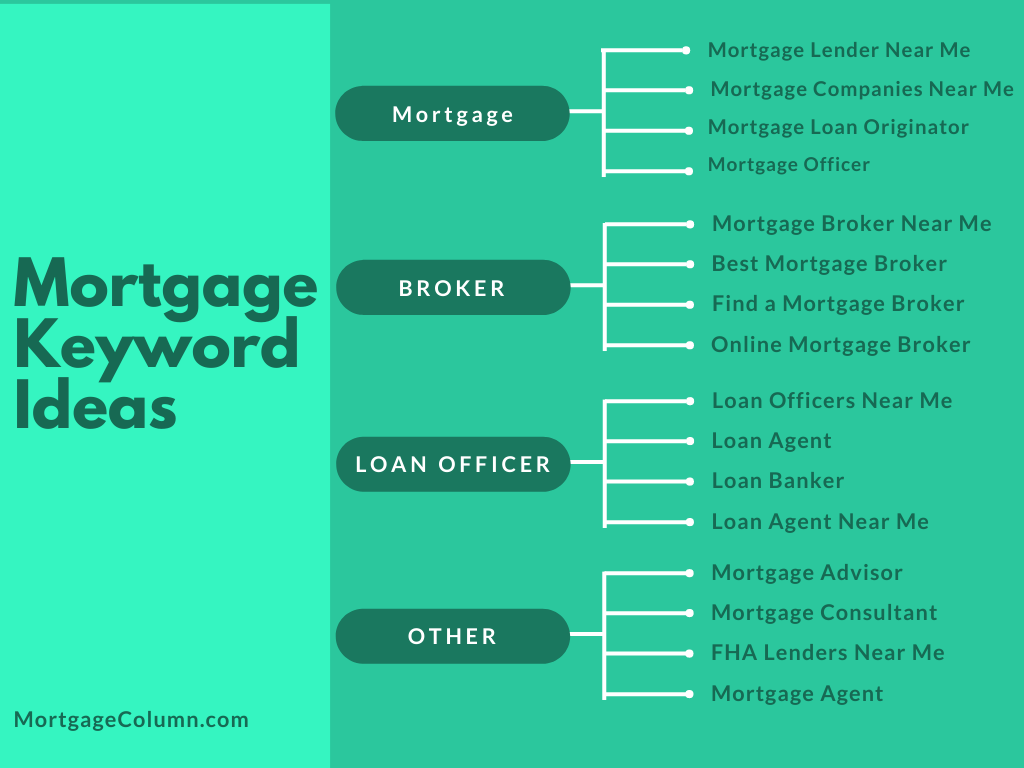

We individually examine all advised products and also services. Home loan brokers help would-be customers locate a lender with the best terms as well as rates to satisfy their economic demands.

They also accumulate and validate every one of the essential documents that the loan provider needs from the borrower in order to complete the home purchase. A home mortgage broker generally works with various lending institutions as well as can use a selection of finance choices to the debtor. A borrower does not have to function with a home mortgage broker.

Some Ideas on Unicorn Finance Services You Should Know

While a mortgage broker isn't essential to assist in the purchase, some lending institutions may only work with mortgage brokers. If the loan provider you favor is amongst those, you'll need to utilize a mortgage broker.

Home loan brokers do not supply the funds for lendings or accept financing applications. They assist individuals looking for house financings to locate a lending institution that can fund their house acquisition.

After that, ask close friends, family members, and business associates for recommendations. Have a look at on-line evaluations as well as look for grievances. When meeting potential brokers, obtain a feeling for just how much rate of interest they have in assisting you get the financing you require. Ask about their experience, the specific help that they'll offer, the costs they bill, and how they're paid (by lender or debtor).

Not known Details About Unicorn Finance Services

Below are 6 advantages of making use of a home mortgage broker. Home loan brokers are more versatile with their hrs and also occasionally happy to do after hours or weekend breaks, conference at a time and also area that is hassle-free for you. This is a massive benefit for full-time employees or families with dedications to think about when intending to locate a financial investment property or offering up and also relocating on.

When you meet a home loan broker, you are successfully obtaining accessibility to several financial institutions as well as their finance alternatives whereas a check out here financial institution just has access to what they are offering which may not be fit to your requirements. As a home capitalist, find an experienced mortgage broker who is concentrated on giving building financial investment financing.

How Unicorn Finance Services can Save You Time, Stress, and Money.

This permits it to become really free from what your loaning power truly is as well as which lenders are the most likely to lend to you. This helps you to determine which lenders your application is probably to be successful with as well as minimizes the opportunity that you'll be refused various times and also marks versus your credit rating background.

Many brokers (however not all) earn cash on compensations paid by the loan provider as well as will solely depend on this, providing you their solutions cost free. Some brokers might gain a greater compensation from a particular lender, in which they may be in favour of and also lead you in the direction of.

An excellent broker works with you to: Understand your requirements as well as goals. Exercise what you can pay for to obtain. Locate choices to fit your scenario. Clarify exactly how each lending works as well as what it costs (as an example, rates of interest, functions as well as costs). Apply for a car loan as well as take care of the procedure through to settlement.

The Best Guide To Unicorn Finance Services

Some brokers make money a typical fee no matter of what car loan they recommend. Other brokers obtain a greater fee for offering specific loans. Occasionally, a broker will certainly charge you a fee straight rather than, or along with, the lending institution's commission. If you're not certain whether you're obtaining a great deal, ask around or look online to see what other brokers charge.

Look the adhering to listings on ASIC Link's Professional Registers: Credit Rating Rep Credit rating Licensee To look, pick the listing name in the 'Select Register' drop-down menu. If the broker isn't on one of these lists, they are operating unlawfully. Before you see a broker, think of what issues most to you in a house financing.

Make a listing of your: 'must-haves' (can't do without) 'nice-to-haves' (could do without) See picking a mortgage for guidance on what to take into consideration. You can discover a qualified home mortgage broker via: a home mortgage broker professional association your lending institution or banks suggestions from individuals you understand Bring your checklist of must-haves as well as nice-to-haves.

The Basic Principles Of Unicorn Finance Services

Get them to explain exactly how each funding choice works, what it sets you back as well as why it's in your best passions. If you are not satisfied with any choice, ask the broker to locate options.